Paradigm: Big Money, Bigger Mission

A Journey Inside Crypto’s House of Renaissance

If the construction of entire virtual cities, an explosion in the popularity of cartoon primates and the emergence of new-age Pokémon as a means of economic freedom aren’t harbingers of a modern Renaissance, then I don’t know what is.

The European Renaissance period was an unprecedented time of cultural, artistic and economic development that laid the foundations for the peaceful modern world. Unlike subsequent peacetimes in the US & UK, the period after the Crisis of the Late Middle Ages was characterised less by a need to rebuild and industrialise infrastructure & physical capital but instead focused more on drivers of social capital - namely education, politics & fine arts.

However, whilst celebrity accrued to those that mastered these domains of importance, power & wealth often did not follow. Instead, the true maestros of the Renaissance were those who built the churches that enshrined the new doctrine of humanism, bought the telescopes that allowed people like Galileo to see into space and bought marble for the sculptors who would go on to build stunning relics to Renaissance society that remain today. No group or person from this period illustrates this better than the Medici family of Florence.

Much like many of those who have generated newfound wealth from technological developments in the past decade, the Medici’s power can essentially be traced to their clever pioneering of a new general ledger system. Having come up with the very-smart-but-equally-dry concept of double-entry accounting, the Medicis used their aristocratic contacts from around Europe to build a banking empire whose mandate spread across what might be described today as wealth management, venture capital, retail banking and foreign exchange. Although the Banco dei Medici did eventually go into liquidation after several generations, it maintains its legacy as a financier and supporter of the infrastructure of the renaissance.

In the most insufferably bullish terms possible, there are fundamental parallels between the transformations enabled by the European Renaissance of the 15th century and the Web3 renaissance of today. For starters:

New financial products are creating new wealth at a rapid rate. The birth of the modern financial system’s role in the fostering of the Renaissance rarely receives popular credit because of how unsexy it is. The sheer innovation of Renaissance-era bankers in creating derivative financial products to skirt usury laws led to a lot of their clients becoming extremely rich off the fruits of small changes in currency exchange rates. The pace of innovation in cryptocurrency (and the tardiness of regulation in keeping up) since its foundation in 2009 has similarly created a lot of wealth for a much wider variety of actors that have gone on to redistribute this wealth to new projects in the ecosystem that have enriched the culture of their environment.

‘Cultural’ passion work is being rewarded at scale. With the introduction of boatloads of money to private actors came demand for higher quality, more individualised leisure goods & services. From this stemmed a new artisanal culture and the rise of the patronage (read: ‘creator’) economy. Where artists may have previously been commissioned to paint at the demands of the church or guild, they were now being paid by the piece to do the work that they wanted to do by their ‘true fans’ (i.e. a more expensive version of the Substack/Patreon model). Nowadays, the emergence of NFTs and limitless distribution channels (Web 2.0) allows creators to more seamlessly securitise their IP and capture the value of work that was once sold out to publications in the name of exposure.

Social capital is being more easily translated into financial capital. In line with the explanation of the shift from Web2 to Web3 as being a transition from ‘read, write’ to ‘read, write, own’, so it follows that the unlimited upside for social capital growth enabled by platforms that can scale content & commentary infinitely can now be financialised and turned into unlimited income. In the Renaissance era, the collection of art often led to an improvement in the economic opportunities available to its owners - the Catholic church was often quite lax in regulating those who had commissioned works that advanced the image of its key figures through the arts.

The Medicis accumulated unprecedented power and wealth for a private family first and foremost because of their contributions to these major societal trends. Given the fundamental similarities between this era and the current dawn of Web3, it begs the question - who will step up to claim the role of Crypto’s Medicis?1

Despite holding an estimated US$2.5bn in assets under management and having an unblemished track record of financing the most ambitious, widely adopted & successful projects in crypto, the story of Paradigm is one that has not been told comprehensively, even as the firm continues to go from strength-to-strength. The firm has all the makings of a Medici-like empire, if not just because of its unmatched treasury: formed as a byproduct of the marriage of two members of the crypto aristocracy (Coinbase & Sequoia), the firm blazed the trail as the largest sector-specific financier, with its beginnings in assisting with the construction of the base infrastructure of the blockchain revolution (Layers 0-2) before diversifying towards land (metaverse projects), art (NFTs & NFT tooling) & gold (crypto finance).

As much as elements of the Paradigm story & the current ecosystem harken back to Renaissance-era Florence, Paradigm’s current trajectory is better described by a quote from a more ancient period of Italian history: Veni, vidi, vici.

TL;DR

With a US$2.5bn war chest, Paradigm are the biggest investors in crypto ventures anywhere. Substantial investments from the endowment funds of Harvard, Yale & Princeton have given the fund a broad remit to scout the entire crypto ecosystem for high value projects, following up on a very successful first fund.

Since the fund’s beginnings in 2017, it hasn’t missed too often. In the first half of 2021, the firm generated an estimated 200% return (as opposed to an industry average of ~15%). This figure counts for the success of some giants in Paradigm’s portfolio, including: FTX, Cosmos, dYdX, Coinbase, Sky Mavis, Compound, Taxbit & BlockFi.

Being a crypto-native fund has its advantages. The token purchase model allows Paradigm to keep their portfolio more liquid than traditional venture funds and has the added advantage of not being constrained by competitive funding rounds as they can fund ventures at any point in time. The intertwinement of crypto & money also gives the firm a clearer idea of the financial standing of most prospective investments than is available for consumer internet companies.

Despite maintaining and sharing extremely esoteric expertise across the blockchain, the team is firmly committed to bringing crypto to the mainstream. Paradigm is host to one of the most reputed protocol research teams in the industry that is responsible for pushing the ecosystem forward. Despite this deep specialisation in the technical elements of blockchains, the firm has been prolific in making user-focused investments that make navigating the world of crypto easier. Citadel Securities could well be the latest, with Paradigm potentially taking the opportunity to onboard a large number of Citadel clients into crypto markets. Bringing crypto to the mainstream has been publicly highlighted as a top priority by both founders.

The Pitch

You would be hard pressed to find someone whose life experiences had better prepared them for the rise of cryptocurrencies than Fred Ehrsam. As a high school student, he got his first taste of digital currencies whilst honing his skills as a semi-professional World of Warcraft player. He would later go on to study Computer Science & Economics at Duke University before matriculating as a foreign exchange trader in Goldman Sachs’ New York office (coincidence?). His discovery of a Georgetown professor’s blog post outlining the potential for Bitcoin in 2012 led him down the rabbit hole, with Ehrsam himself describing an obsessive impulse to check bitcoin prices on trips to the bathroom at Goldman.

Ehrsam’s true sojourns into crypto, however, begin with a fateful exchange of bullish views on the future of cryptocurrency on Reddit. On the other side of that exchange was Brian Armstrong, an Airbnb software engineer who was slightly further down the rabbit hole than Ehrsam at that point, having just been accepted into Y Combinator with an idea for cryptocoin storage that he had been working on during his nights and weekends. The price of bitcoin was fluctuating around $6 at the time.

When he had applied to the accelerator programme, Armstrong had been working on the project remotely alongside another programmer, Ben Reeves. At some point prior to the beginning of the programme the pair came across an irreconcilable difference of opinion with regards to whether their ‘PayPal for Bitcoin’-style wallet should retain access to users’ private keys such that the contents would never truly be lost. Less than 2 days out from Y Combinator, the pragmatist Armstrong sent the purist Reeves a politely worded email informing him he would no longer be needed and that he would go it alone from here on out. That was until he logged onto Reddit one evening to read a bullish young trader’s astute comments on Bitcoin.

For four years Ehrsam operated as Coinbase’s President, overseeing the platform’s growth as it went from 0 to 5 million users at the time of his departure prior to Bitcoin’s explosion in popularity in mid-to-late 2017. As a substantial shareholder in the company (estimated at 6% in 2021), Coinbase’s historic 2021 listing values Ehrsam’s shareholding at US$2.97bn at the time of writing.

At around the same time that Brian Armstrong brought Fred Ehrsam alongside him on the Coinbase journey, a previous Y Combinator alumnus was figuring out their next moves. Matt Huang had just finalised the sale of his advertising & social media analytics startup Hotspots.io to Twitter, a move that was mostly described in the press at the time as an astute acquihire for the microblogger’s revenue engineering team.

While there are no disclosed figures about exactly how large a windfall Huang received from the acquisition, the joint effect of his expertise in social interest mining and the profile of his role at Twitter put him on course for an introduction to some of China’s social analytics pioneers on a trip to Beijing in 2012. One of those pioneers was Zhang Yiming, who had founded his AI-powered content machine Toutiao (under the corporate name ByteDance) only 3 months prior. Having built predictive social media tools himself, Huang knew immediately that Zhang was sitting on a gold mine and managed to get an allocation as an angel investor in the company.

Huang would go on to follow-up in the company’s Series A and B rounds, riding it all the way to a valuation estimated at the time of writing to be in excess of US$400bn. Huang would go on to solidify his track record as a prescient angel investor, snapping up stakes in Instacart (current value US$39bn), Benchling (US$6.1bn) and Amplitude (US$4.5bn). With this kind of track record in private investments, Huang’s move across the Bay to interview for venture capital firms on Sand Hill Road was a logical next step.

As part of the screening process for employment at Sequoia Capital, candidates are asked to prepare an investment case for an early stage company that they are bullish on. When Huang interviewed in 2014, he settled on pitching Coinbase, a nascent cryptocurrency wallet & exchange platform that had recently graduated from Y Combinator. If this seems like a stroke of fate, I implore you to hold your horses - after a very successful first 3 years with Sequoia that saw Huang manage investments on the firm’s behalf in businesses including Stripe, Reddit & YikYak, destiny finally knocked on Huang’s door when Ehrsam and members of the Coinbase team came to pitch Sequoia for Series B funding and test just how bullish the young investor was when he drafted the screening pitch three years prior.

They passed. Twice. Coinbase went on to become Wall Street’s first crypto darling, fetching a valuation of US$86bn upon its listing.

Though their first interactions in the professional sphere lead nowhere, Huang was still impressed enough by Ehrsam to follow his online profile more closely. When Ehrsam blogged about the potential of blockchain-based VR applications powering virtual worlds, Huang went so far as to ask if there was any possibility Sequoia could fund him in a pursuit to bring the idea to life.

While Ehrsam had no intent on bringing this idea to life, it sparked a long-lasting email exchange that made it very apparent to both that they shared the same opinions about the future of cryptocurrency. Having both spent the past five years honing a knack for being in the right place at the right time, they decided to settle together in the one space that they saw immense growth for the coming decades - blockchain.

The Paradigm Playbook

First Principles

For a firm with all of its eggs in the one vertical, Paradigm’s approach is refreshingly non-maximalist and balanced across the ecosystem. The only slightly maximalist notion that both founders agreed upon (and presumably many of the staff believe as well) was that from 2017 onwards all of the cool startups would be in crypto, hence the market focus.

The two guiding theses that guide Paradigm’s raison d’etre are that 1) cryptocurrency & the wider blockchain will simultaneously transform finance and the internet and 2) that accelerated technological flows are the sum of funding and expertise. While the founders don’t dismiss the transformational benefits of the current internet (both were hardcore netizens throughout the middle stages of Web2.0 growth), they see newfound growth stemming mainly from the following:

Establishment of widespread property rights through tokenisation & improved distribution of merit-based rewards for adding to blockchain-based ecosystems

Digital environments (‘metaverses’) that provide an improved way for people to interact, learn & earn - particularly for those whose current real-world economic, social and even physical circumstances are sub-optimal

A breaking down of the barriers of entry & exit erected by many of the existing tech giants that will vastly increase the range, size & volume of opportunities available to entrepreneurs, creators & users.

For those familiar with the common narratives of Web3 adoption, none of the above will be too surprising. Having trawled the interwebs for any investment theses the founders have expressed publicly, there is only one that comes across as remotely contrarian: that, at least in the short-run, complete decentralisation may not be the best path to widespread adoption.

Those who were patient enough not to skim over the earlier parts of this piece may vaguely remember how the Coinbase founding story was dramatically shaped by a similar issue of decentralisation, where original co-founder Ben Reeves was disengaged from the company as he believed that giving the administrator the right to store a user’s private keys betrayed the crypto constitution (Bitcoin whitepaper). Aside from an obvious knowledge of the space in its most nascent stages, Ehrsam also largely owes his rise to the role of Coinbase co-founder & President to a shared vision with current-CEO Brian Armstrong that the best way to bring the masses into crypto was by fostering the safest and most convenient experience in the industry, even if that didn’t best represent the original vision of its creators.

This is not to call either Armstrong or Ehrsam traitors to the Web3 vision. To borrow an analogy from Ten Pin Bowling, proponents of this vision see putting the rail bumpers up and letting the ball hit the pins as the best way to make people fall in love with the game, whereas the likes of Reeves would rather only see those who could stomach the likelihood of a gutterball make it through the other side with a clear understanding of the trials, tribulations & rewards of the game.

Ehrsam has transmitted this approach to mainstream crypto adoption into Paradigm’s DNA - while they do have substantial holdings in purely decentralised protocols & exchanges, there is a significant desire to support these with services that protect builders & users from bad actors and their own occasionally mindless actions.

Another key factor in the Paradigm model that is sorely missing in the sentiment of swathes of retail & institutional crypto investors alike is an aversion to actively trying to time the market.

This disregard for picking the best value at the exact right time isn’t born out of a lack of knowledge of the nuances of crypto’s notoriously cyclical nature - quite the opposite, this piece by Ehrsam on cycles appears frequently on curated lists as required reading for those trying to break into cryptocurrency trading. Rather, pretty much all of the firm’s employees’ ventures in crypto have lasted far longer than the latest bull-run, meaning that they have been around long enough to understand that regardless of timing, the cream rises to the top. These folks were all around when projects like Axie, Solana & essentially the entire Ethereum ecosystem blossomed out of the depths of Crypto Winter. In this knowledge comes a solidarity that regardless of what CNBC has to say about the Bitcoin price, world-changing projects will continue to be built, altered, forked and organised on blockchains for the benefit of their users and, hopefully, Paradigm’s bottom line.

VC Done Differently

I mentioned above that a lot of the defining projects of the most recent upswing in Web3 development have their foundations in a period where many previous investors had been burned and had no interest in the space while the rest of the world looked on and viewed cryptocurrencies as a whole to be one-and-done. While there has been much made about VC fundraising infringing on the degree of centralisation in Web3, at the end of the day there should be just rewards for those that are willing to put their hands to the coals and fund the development of these projects long before public tokens are issued and the project has a chance at becoming financially self-sustaining. Without meaning to evangelise institutions whose sole aim is to generate a return for its investors, in many cases VC money is necessary to either kickstart or scale transformational projects that will go on to provide incrementally greater benefits for their users.

Having been founded in these dark ages, Paradigm owes a lot of its success to making extremely prescient bets on promising projects at a time when their value and capacity to grow exponentially was not obvious. While this shrewdness may elicit some similarity to the rise of post-dot-com-bubble titans like Sequoia, a16z and Kleiner Perkins, on closer inspection Paradigm is a very different kind of fund. It could almost be thought of as the anti-a16z:

Beyond their operating model and organisational structure, the market that Paradigm operates in also lends itself to a new way of doing VC. Given the prominence of tokens as a means of exchange and mode of governance across Web3 applications, Paradigm and other crypto-native venture firms have made the leap to making substantial purchases of tokens in their investments rather than writing a cheque in exchange for equity. This offers three massive benefits for venture funds:

1) Unparalleled liquidity

2) No need for overzealous party rounds and jostling for majority stakes

3) Improved ease of capital deployment

This model takes advantage of the improved efficiency of blockchain-based smart contracts to radically decrease the amount of time builders spend fundraising, negotiating and sorting out logistics whilst also vastly improving the liquidity of the VC as they can sell the tokens at any time. The speed at which firms can enter & exit their investments makes blockchain-based projects function like an investment in a public company minus the reliable access to information via reporting requirements.

Secondly, buying token stakes in a business at any given point in time as opposed to discrete funding rounds allows funds to avoid the circus of the infamous party round. Industry insiders estimate that Tiger Global Management, the pre-eminent VC fund of the past half-decade, will pay a premium of anywhere between 25-50% more than their estimated fair value in order to lead a funding round for their target companies. On a total 2021 deal volume of US$10.5bn, this ‘party’ premium therefore costs Tiger anywhere between US$2.1 - 3.8bn on top of the fair value of the deals they were winning. Whilst Tiger is an outlier (and they still generate a robust IRR of ~20% despite the premium), this activity is representative of the inefficiencies inherent in the traditional VC model, inefficiencies that token investments allow firms like Paradigm to avoid.

Less a testament to the token investment model but more indicative of the efficiency of blockchain-based systems more generally is the ease and speed at which these funds can deploy large and small sums of capital alike. If a project had a fixed volume of tokens on issue or planned to be issued, Paradigm could purchase 5 million tokens with a similar ease to a retail investor buying 1.

The inseparability of Web3 & money also lends Paradigm another less obvious advantage over traditional VCs. Where firms like Sequoia and Kleiner Perkins had to project and justify a million different user growth metrics for unprofitable consumer businesses looking for outside money to keep the lights on until they figured out, Paradigm and crypto-native venture firms have a litany of financial information available on prospective investments simply because the nature of the ecosystem means that many of them already deal with substantial financial flows in their very early stages. Just as it has done for retail investors the world over, the permissionless nature of crypto also serves to enrich institutional backers.

Champion Team & Team of Champions

Just as a new form of venture asks for new modes of investment and new ways of evaluating business models, so does it also ask for a new method of hiring. No one shows this better than Paradigm. Whilst in the early stages of ‘big crypto’ it hasn’t been unusual to see management teams prioritising onboarding new team members who have had some experience or interest in the space, Paradigm takes it to another level. Almost everyone from the investment team all the way to the administrative assistants has had some form of exposure to venture capital or cryptocurrency in a professional capacity.

From the get go, gathering the most impressive people in the space was one of Huang and Ehrsam’s foremost priorities. In an interview on Bloomberg’s UpOnly podcast, the two describe their individual first, job description later approach to hiring that has seen them bring some of the most reputed builders and intellectuals in blockchain onto their payroll. Examples include Dan Robinson & Dave White, the two researchers who have produced some of the industry’s most pioneering protocol research under the Paradigm umbrella; Sam Sun (samczsun), the pseudonymous white-hat hacker who currently sits atop the Ethereum Bounty Leaderboard whilst working at Paradigm as a Security Researcher; and Charlie Noyes, the first investment team member to join after Ehrsam & Huang who currently manages US$100mn worth of the firm’s positions having joined from Pantera Capital in 2018, where he was a Principal. He’s 21.

In the same UpOnly episode as referenced before, one of the hosts jokingly makes a very good point - it’s impressive enough that the fund was able to hire the staff it currently has on payroll, but what’s even more impressive is the culture that it has built to keep people in place who could go it on their own and be unbelievably successful but who stay at the firm for the quality and diversity of problems it allows them to work on.

From Blockchain Rails to Direct Sales: Investing in User Stories

The dual missions of being the most powerful commercial blockchain research hub and being the earliest and most useful partner for ambitious ($1-100mn first cheque size) crypto founders unsurprisingly go hand-in-hand when it comes to keeping Paradigm on the frontier of protocol investments.

For a firm with such expertise in protocol research, however, it is telling just how much of the firm’s attention has been devoted to the user-side of crypto. While the graphic above indicates a heavy weighting of the fund towards facilitating cryptocurrency ownership, transactions & lending, there is still a substantial amount of diversity in the functions of portfolio companies.

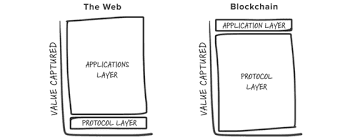

Beyond diversity, there is another thing that strikes the eye about this graphic as being immediately contrarian. One piece of commonly accepted wisdom among crypto investors is that of the ‘fat protocol’, whereby the relationship between value captured by the protocol layer (i.e. Ethereum in the case of blockchains, Android in the case of the Web) compared to the application layer (i.e. NFTs in the case of blockchains, Facebook in the case of the web) are flipped. Following this logic, it would make sense for VCs to follow the value and heavily weight their portfolios towards investments in protocols.

Paradigm’s investments (proportionally) don't subscribe to this logic. Instead, it has supported founders building products and platforms that in many cases seek to improve the ease of using crypto through user-facing applications, making it more attractive to the masses.

This graphic attempts to illustrate just how comprehensively the Paradigm portfolio could cover the onboarding experiences of a new user to crypto, all on the application layer:

The first thing that this shows is how much the firm has put behind helping bring easy-to-use tools to the masses of new users. The second thing that is striking is just how interlinked it all is - whilst Argent’s DeFi wallet plays the role of connector in this graphic, realistically it could be replaced by a large number of platforms in the Paradigm portfolio that weren’t included in this graphic for time’s sake.

The emphasis I’ve placed here on the consumer-side of Paradigm’s portfolio isn’t to suggest that they have ignored protocols or infrastructural tools altogether. To the contrary, a lot of the firm’s first investments were in the more base layers of the blockchain. A similar graphic for institutional uses of Paradigm’s portfolio platforms could just as easily be designed to illustrate the A-to-Z range of applications for businesses, and I imagine the same would go for developer uses (I just had no business trying to unravel the technicalities behind it).

Instead, I point it out to reaffirm the firm’s extraordinary commitment to improving the accessibility and opportunity available to new users in the space. It’s arguable that some of this wouldn’t have been possible without the initial investments in infrastructure.

What If…?

One of the things that is most frustrating about being a crypto novice is the occasional difficulty in navigating across chains and trying to figure out the logistics of getting from Point A to B (e.g. in my case it took ages to figure out what and how to swap tokens in order to stake TIME).

Looking at the interconnectedness of this portfolio and all of the platforms’ shared connection to Paradigm makes it easy to imagine what a completely seamless onboarding experience might look like. Imagine if all of these services were bundled into one crypto ‘super-app’ to create ultimate ease of use. To use my staking example from above, instead of having to follow the painstaking process of:

verify exchange account → set up & verify wallet → deposit coins to wallet → swap coins to relevant currency → deposit new coins into staking mechanism → keep track of yields until deposit;

Users could instead go to their Argent DeFi wallet, select a DeFi project that they want to stake with and the USD/fiat amount they would like to invest and, voila, the system automates the painstaking intermediary steps to help the user on their way to yield farming through integrations with the above pictured portfolio companies. Obviously there are some technical barriers that might make such automation really difficult, but the fact that integrations already exist between certain platforms in the Paradigm portfolio (e.g. BlockFi wallets enabling TaxBit integrations) suggests that it is not an impossibility. A second roadblock might be the ideological dilemma of bundling decentralised services to create a centralised convenience.

This example only covers one possibility (staking) that an all-in-one crypto wallet solution could offer users. Other possibilities might include being able to directly monitor price changes in differentiated holdings across stablecoins (Dai), index funds (Numerai), NFTs (Zora, Royal) & etc., immediate currency swaps within the wallet (Uniswap) or displaying aggregated market data (Coin to find the most efficient prices for users across platforms. The closest analogy would be a blockchain-based Alipay or WeChat Pay with all the bells & whistles that these services offer, but for cryptocurrencies. Such a one-stop-shop would vastly reduce the barriers to understanding some of the nuances of navigating DeFi & Cryptocurrencies more generally and in doing so, allow many more to access the opportunities available in what Huang believes to be a “new financial system”.

Breaching the Void

Ken Griffin is perhaps best known by the masses for his alleged dual role in the GameStop saga, where he was accused by Congress of both working with Robinhood (a firm that generates 35% of its revenue through payments from Griffin’s market making and firm, Citadel Securities, for the platform’s order flow) to suppress surges in the stock’s price by imposing halts on trading, whilst also receiving much internet backlash for his role in propping up exposed short-seller Melvin Capital with a $2.75bn capital injection after the firm lost 30% of its AUM on 7 very poorly timed bets on the video-game retailer’s demise. The disregard for Griffin has extended to a website that has curated all of his alleged misdemeanours, Google having to block the autocomplete function when his name is followed by the term ‘perjury’ and, as is par for the course, the thousands upon thousands of creatively hateful comments across Twitter and Reddit.

Perhaps less known is Griffin’s role in another piece of internet history. When one of the last 11 surviving copies of the US Constitution was put on auction by Sotheby’s last year, seven internet friends had the brilliant idea of forming a DAO to crowdfund its purchase. ConstitutionDAO would go on to raise an amount rumoured to be in excess of US$47mn to buy the document, which would have been almost $10mn more than enough to buy the next most expensive document ever put up for auction.

But it fell through. Far from being simply outspent or expelled by the auction house as the bids gradually ticked up, the fate of the constitution was sealed in an 8-minute telephone bidding war between representatives of the DAO and … Ken Griffin.

There are two ways of looking at this last part of the story, and the way you view it is arguably very important to your perception of the views presented in the rest of this piece. The blue pill option is to accept the logic of the GameStop masses - Ken Griffin is a pettily vengeful billionaire who perfunctorily dropped $43mn on the constitution to spite the same class of online memelords that had dragged his name through the dirt earlier that year. In the other hand sits the red pill - Griffin bought the document out of a sense of civic duty to put it on display for all Americans to remind of the rights that they are entitled to (but also kind of because his son asked him to), going so far as to even offer ConstitutionDAO joint governance of the document and the right to mint NFTs of Griffin’s copy. While no agreement was reached, this part of the story is important because, if true, it enlightens the debate about whether what follows is indicative of a hedge fund billionaire’s technological redemption arc or a conspiracy to corrupt the foundations of the future of finance.

Last week, parts of social media were outraged and others were bewildered upon the news of Griffin’s already sizeable net worth being readjusted another $6.5bn upwards after Citadel Securities finally took their first US$1.15bn in venture capital money from Sequoia and Paradigm in the worst success story for bootstrapped startups everywhere.

As head-scratching as Sequoia’s leading the investment in a world-leading public equities market maker was, Paradigm’s contribution might be even more so. For better or worse, internet discourse and memes are a significant driving force in the crypto ecosystem and the firm had just allocated a portion of its fund to investing in one of the internet’s favourite straw men. Why?

Some possible answers:

Citadel is dipping its feet into DeFi. Regardless of what happens next, this is already true by proxy because it now joins the portfolios of two of the biggest crypto investors in the world. This tweet captures the synergy here perfectly. Uniswap pools liquidity from degenerates for crypto projects, Citadel pools liquidity from white billionaires to buy baskets of stocks. Two sides of the same coin.

There is every chance that Citadel sees the synergies between the fiat liquidity it currently provides en masse to institutional investors and the possibility of providing liquidity via major staking positions in DeFi projects that offer far superior yields. If this possibility went to its furthest extremes, Citadel could generate outsize returns by either building up large staking positions in existing staking platforms, consulting new projects on how to attract liquidity providers or starting their own projects altogether.

Paradigm is dipping its fit into TradFi. Facing the constant possibility of a bear market, gaining exposure to a share in a traditional finance firm offers Paradigm a hedge against the volatility of the markets that they operate in.

Both firms are betting on a more integrated future for TradFi & DeFi. There is every chance that Paradigm is using the share purchase as a means to acquire some of Citadel’s high-volume institutional trading customers, and Citadel is happy to take them on in order to meet the demands of some of their more adventurous clients. Paradigm’s vast suite of financial services in their portfolio offers an array of opportunities for Citadel clients to explore & profit within the ecosystem. Furthermore, the move could be a bet by Paradigm on the possibility that the SEC recognises digital currencies as securities, which could position them to use their new partner to create markets for a wide range of platforms and products in their portfolio.

Beyond these three categories, there are some other obvious benefits of the deal. For Citadel in particular, the $6bn boost the investment gave to their valuation puts them firmly in line for an exploration of the public markets and a chance to provide some more transparency on their operations to the public. The investment also brings the crypto world one step closer to reclaiming Ken Griffin’s copy of the constitution.

Final Thoughts

Cosimo de Medici was the man at the helm for the most profligate years of the Medici Bank’s long dynasty. One of the doctrines that he instilled in the organisation and in his family was a commitment to being inoffensive to the rich & strong, and consistently charitable to the poor & weak.

One of the great benefits of the crypto-based financial system is its capacity to give anyone in the world access to opportunities for immense wealth creation so long as they have a computer and an internet connection. By providing & funding public access platforms, tools and information for this future Paradigm is, in some sense, being consistently charitable to the world’s less well-off (relative to the inheritance class).

As impactful as their work has been in the domain of funding awesome projects, the deal with Citadel is significant because of its alignment with the first half of Cosimo’s axiom. Far from just being inoffensive, the arrangement serves to act as an olive branch between high finance and the blossoming world of crypto finance that serves to expand the opportunities available to all.

If one thing is clear, it is that Paradigm is a massive fund with a big mission to onboard as many users into the ecosystem as possible wherever they may come from, bumper rails and all.

A bit of digging finds that the descendants of the original Medici might have a claim themselves.